Why Liveness Detection is Essential for Customer Identification

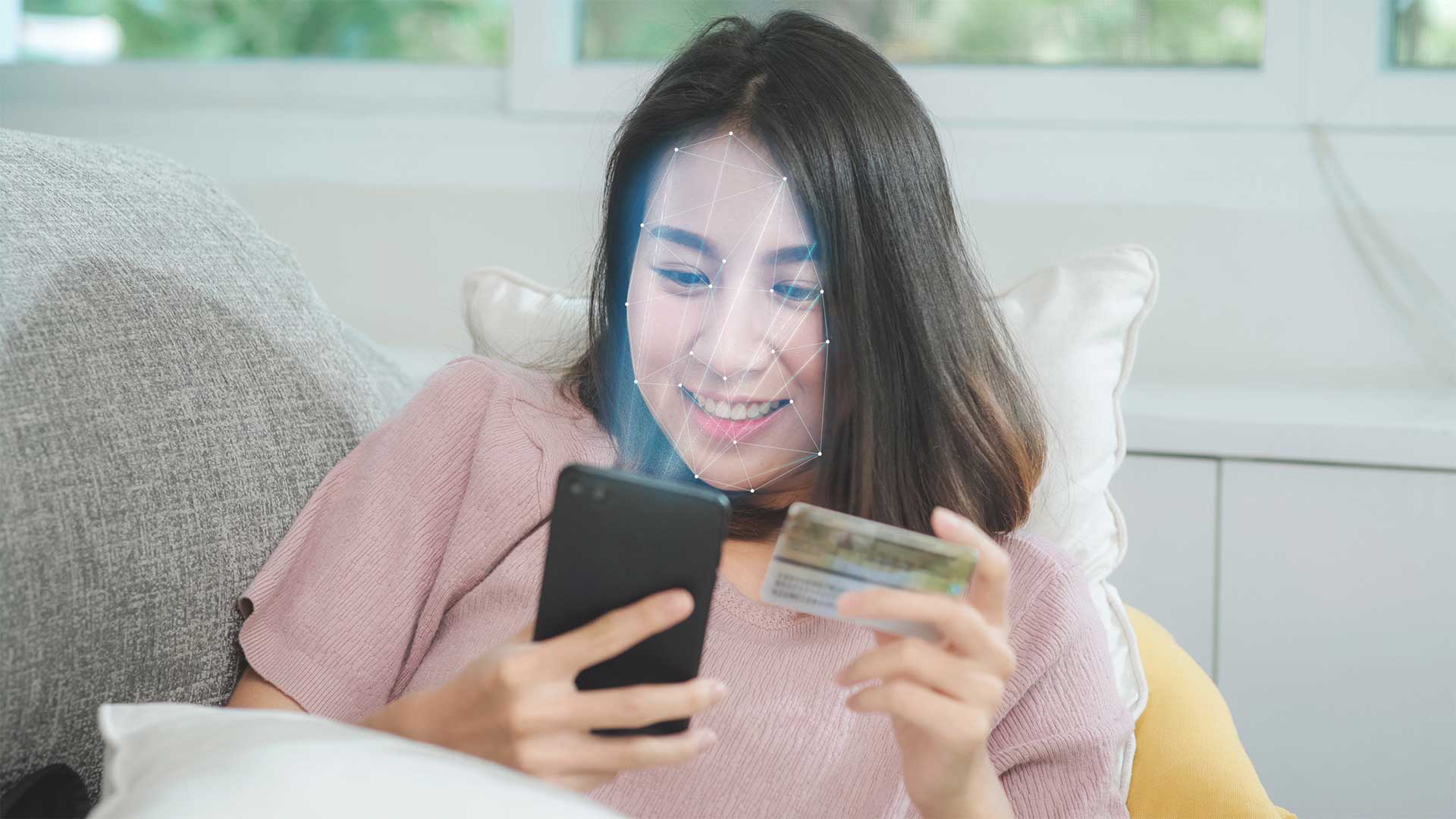

The use of smartphones for customer identification is becoming increasingly commonplace. Since COVID-19, more customers are demanding ways to do more with their own devices, including everyday financial transactions. But for many companies, effective user authentication is still lacking – and the risks are growing every day.

As Mobile Banking Expands, the Incentives for Spoofing Fraud Increase

As a result of these changes, security vulnerability is growing. Many companies, including financial institutions, are relying more on their digital platforms which can have fatal weaknesses:

- Passwords are easy targets

- Two-factor identification (2FA) is surprisingly susceptible to exploits now

- Biometric authentication is subject to physical spoofing such as fake fingerprints and masks

- Three-dimensional face detection tests can be simulated

So how can businesses protect against these attacks? Typically, visual puzzles (“identify the images”) and other bot-proofing tests have been used as a basic form of “livenes detection”, but these tests also create a lot of customer friction and frustration.

How does Liveness Detection Improve Customer Identification?

Companies can now offer far superior customer identification through seamless and secure liveness detection. Here’s how it works:

- Liveness detection identifies the actual presence of a specific, unique person

- Spoofed, static images, even 3D, can’t present the required dynamic factors to cheat it

- While 3D face mapping algorithms sometimes include motion, they are also caught out when they fail AI and ML correlation.

Using unique algorithms, liveness detection evaluates unique aspects of human facial behavior over a short time. These algorithms operate like a key, with go or no-go results.. In fact, the most recent liveness detection strategies introduce a new paradigm where the result is based on collective facial movement, like emotional expressions, making attacks with face masks virtually impossible.

Why Liveness Detection is Essential in Authentication Security Models

Liveness detection answers the shortcomings of 2FA, fingerprints, and basic face detection. It helps authenticate transactions, prevents automatic creation of fake accounts, and reduces the biometric identification security burden on customers while improving protection. The underlying algorithm is compute-heavy, but simplifies the customer actions. For data, it uses a 2-second, repositioning video capture most phones can perform.

Testing of effective algorithms has established a high rate of success for live, authorized customers using this method, and a very high rate of rejection for bad actors. Liveness detection restricts fraud and spoofing exposure, and provides a strong biometric authentication basis for concerned financial organizations expecting a growth in mobile customer activity.